Chapter 1: Define Your Trading Goals

Defining your trading goals is essential before searching for a forex broker. Consider questions such as:

1.1. What is your preferred long-term investor?

1.2. What is your risk tolerance? Are you comfortable with high-risk, high-reward strategies, or prefer lower-risk, conservative approaches?

1.3. Which currency pairs do you want to trade?

1.4. What are your profit expectations and capital availability?

Clearly outlining your trading goals will help you narrow your broker choices to those that align with your objectives.

Chapter 2: Regulatory Compliance

2.1. Regulatory Bodies

Ensure that a reputable financial authority regulates the forex broker. Some well-known regulatory bodies include:

Regulation protects traders, including segregated client funds and adherence to financial standards.

2.2. Check the Broker’s Regulatory Status

Verify the broker’s regulatory status on the regulator’s website. Ensure that the broker is not just claiming to be regulated but is genuinely registered and compliant.

Chapter 3: Trading Costs and Fees

3.1. Spread and Commission

Understand the broker’s fee structure. Most brokers earn revenue from spreads (the difference between the bid and ask price) or commissions. Compare spreads and commissions to find the most cost-effective option for your trading style.

3.2. Overnight Financing and Swap Rates

For traders who hold positions overnight, it’s crucial to consider overnight financing costs, also known as swap rates. These fees can significantly impact your trading profitability.

Chapter 4: Trading Platform and Tools

4.1. Trading Platform

The trading platform is your primary interface for executing trades and analyzing the market. Key considerations include:

User-Friendliness: Is the platform intuitive and easy to navigate?

Charting and Analysis Tools: Does the venue provide technical analysis tools?

Mobile Trading: Is there a mobile app for trading on the go?

Order Execution: How fast and reliable is order execution on the platform?

4.2. Compatibility

Ensure that the trading platform is Android or iOS.

Chapter 5: Asset Selection

5.1. Currency Pairs

Different brokers offer varying selections of currency pairs for trading. If you have specific couples you wish to trade, make sure your chosen broker offers them.

5.2. Additional Assets

Some brokers provide access to other financial markets, such as stocks, commodities, or cryptocurrencies. If diversifying your portfolio is part of your trading strategy, consider brokers that offer a broader range of assets.

Chapter 6: Leverage and Margin

6.1. Leverage Options

Determine your comfort level with power and choose a broker with suitable leverage options.

6.2. Margin Requirements

Understand the broker’s margin requirements, as they can vary significantly. Margin requirements dictate how much capital you need to maintain open positions.

Chapter 7: Customer Support

7.1. Availability

Check the availability and responsiveness of the broker’s customer support. You’ll want a broker with accessible customer service, especially during trading hours.

7.2. Support Channels

Consider support channels like phone, email, live chat, and social media. Quick and effective communication is vital when issues arise.

Chapter 8: Educational Resources

8.1. Educational Material

For novice and experienced traders, educational resources can be invaluable. Look for brokers that offer educational materials, including webinars, tutorials, and trading guides.

8.2. Demo Accounts

It’s an excellent way to familiarize yourself with a broker’s platform and test your trading strategies without risking natural capital.

Chapter 9: Reviews and Reputation

9.1. Online Reviews

Research online reviews and forums to gauge the broker’s reputation. While individual experiences vary, consistent issues or positive feedback patterns can provide insights.

9.2. Regulatory Disciplinary Actions

Check whether the broker has faced any regulatory disciplinary actions or fines. A history of regulatory violations can be a red flag.

Chapter 10: Account Types and Minimum Deposits

10.1. Account Types

Brokers offer various account types, including standard, mini, and micro-accounts. Ensure the broker’s account types match your trading capital and goals.

10.2. Minimum Deposit

Different brokers have varying minimum deposit requirements. Choose a broker with a minimum deposit that fits your budget.

Chapter 11: Account Funding and Withdrawal

11.1. Deposit Methods

Review the deposit methods offered by the broker. Standard deposit options include bank transfers, credit/debit cards, and electronic wallets (e.g., PayPal, Skrill). Ensure that the broker supports your preferred funding method.

11.2. Withdrawal Policies

Understanding withdrawal policies is crucial. Check for any withdrawal fees, processing times, and minimum withdrawal amounts. A reputable broker should facilitate timely and hassle-free withdrawals.

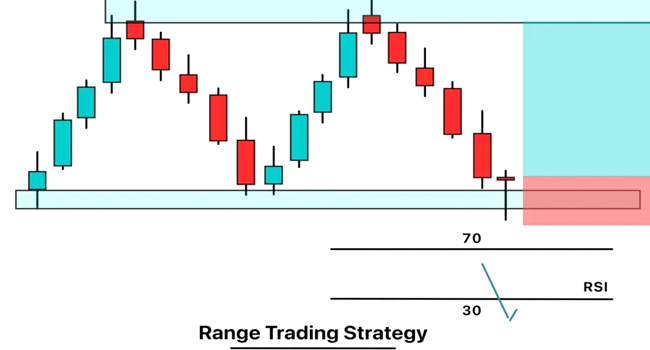

Chapter 12: Trading Tools and Additional Features

12.1. Trading Tools

Consider the additional trading tools and features provided by the broker. These may include:

Auto-trading platforms: Support for automated trading systems like MetaTrader’s Expert Advisors (EAs).

Market research: Access to research reports, economic calendars, and technical analysis tools.

Risk management tools: Features like guaranteed stop-loss orders and negative balance protection.

12.2. VPS Services

Some brokers offer Virtual Private Server (VPS) services, which can enhance the reliability of automated trading strategies. If you use EAs or algorithmic trading, a VPS may be beneficial.

Chapter 13: Scalability

As your trading skills and capital grow, you may need a broker that can accommodate your evolving needs. Consider a broker’s scalability in terms of account types and leverage options. A broker that can grow with you can save you the hassle of switching platforms as your trading career progresses.

Chapter 14: Community and Social Trading

14.1. Social Trading

If you’re interested in social trading, look for brokers that offer this feature.

14.2. Trading Communities

Some brokers have active trading communities or forums where traders can share insights, strategies, and experiences. Being part of a trading community can provide valuable support and education.

Chapter 15: Security and Data Protection

15.1. Security Measures

Check the broker’s security measures. Look for brokers that use encryption technology to protect your personal and financial information.

15.2. Data Protection

Ensure that the broker adheres to data protection regulations and does not share your information without your consent.

Chapter 16: Trial Period

Before committing to a broker, consider opening a demo account to test their platform and services.

Chapter 17: Broker Reputation and Feedback

Continuously monitor the broker’s reputation and gather feedback from other traders. Online forums, review websites, and social media can be valuable sources of information about a broker’s performance and customer satisfaction.

Chapter 18: Customer Support and Responsiveness

Consistent and reliable customer support is essential. Test the broker’s customer support responsiveness by reaching out with questions or concerns. This will help you assess their ability to address issues promptly.

Conclusion

Selecting the right forex broker is a pivotal decision in your trading journey. Remember that the forex market is highly competitive, and broker offerings can change. Regularly reassess your broker to ensure it continues to meet your evolving trading requirements.